The evolutionary field of Fintech Apps has now come along to change and will show what’s next for Fintech.

How people handle money, transact, and consider banks by revolutionizing their perception.

The Revolut app is one of these disruptors and it has changed how you handle money across the globe.

The Rise of Fintech Apps

There are many Fintech Apps such as Revolut which have changed the way people bank, making it more flexible and less traditional.

However, such apps are breaking down boundaries courtesy by app developers ensuring that people can access financial products anywhere, even in remote areas.

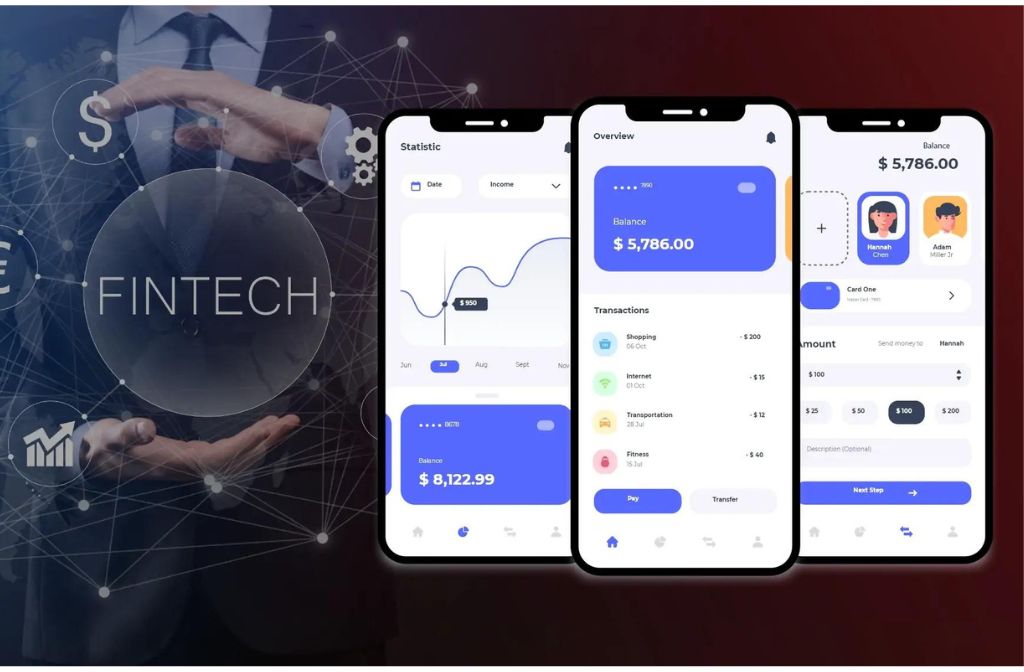

Revolut and other Fintech Apps enable individuals with unique characteristics such as user-friendly interfaces, convenient banking operations, and individual financial intelligence that equip them with better knowledge on how best to deal with cash at home and abroad.

The Future Landscape Of Fintech Apps

The next-generation landscape app development company in New York promises a new age of widespread use, individually targeted funds, and revolutionary change.

As we speak, fintech Apps are still reinventing the whole world of finance, as we have techy users looking for straightforward solutions for their challenges and opportunities.

In addition, the emergence of new technologies should lead to democratic financial services with AI, blockchain app development, and big data for individual experience.

The future is set for a more connected and inclusive financial system with key trends in Fintech apps leading change as innovation becomes the backbone on which traditionally rigid boundaries are broken.

Exploring the Revolut Experience

The borderless abilities of Revolt allow customers to do worldwide transactions without huge expenses, exchanging currency at interbank rates, making it easier for frequent travelers and businesses between countries.

Multi-currency accounts feature on the app, making it possible to hold, exchange as well and transact in any currency you desire.

The budgeting tools and analysis offered by Revolut empowered users to track employee spending in real time and instilled financial discipline.

The Impact on Global Finance

The fintech apps disrupt conventional banking tradition prompting legacy institutions to respond to changing financial realities.

Financial apps such as Revolut greatly contribute towards financial inclusion due to their ease of use, and that includes people who don’t have banks.

It shows how innovation drives away changes, giving a resolution tailored to the modern user’s needs and aspirations.

Redefining Financial Norms

Revolut disrupts finance while incorporating strong security measures like encryption and security rules so that users can have confidence in it.

Partner up with different sectors for service improvement, and product expansion, as well as addressing customers’ needs and preferences toward financial technologies.

Despite this, it is still difficult for Fintech apps to navigate existing regulatory frameworks, yet they commit to comply with regulations and strive to achieve conformity.

Revolutionizing Finance

Revolut portends a new era of easily accessible and innovative finances.

These enterprise mobile app development company in New York have transformed the global finance landscape, presenting users with unlimited freedom, convenience, and power for managing global finances.

With time, such Fintech Apps will play greater roles in redrawing the future of finance toward inclusive forms of service delivery incorporating state-of-the-art technologies.

Conclusion

Fintech Apps act as disruptors of conventional practices in the financial sector by introducing participatory and client-oriented approaches.

which connects various people around the world in a way that creates opportunities even among the otherwise underserved populations who have difficulties gaining access to available finances in society.

Apps help in collaboration, navigate the complexity involved with regulation, and ultimately, create trustworthiness and reliability.

However, Fintech Apps remain front runners on the way towards the future of finance that will be accessible, responsive, and safe.

The Fintech Apps journey represents more than a revolution, it is an aspiring vision of a techno-based, open society’s financial future.